Stocks: More Fluctuations

Stock prices are hovering near their local highs. Will the uptrend continue?

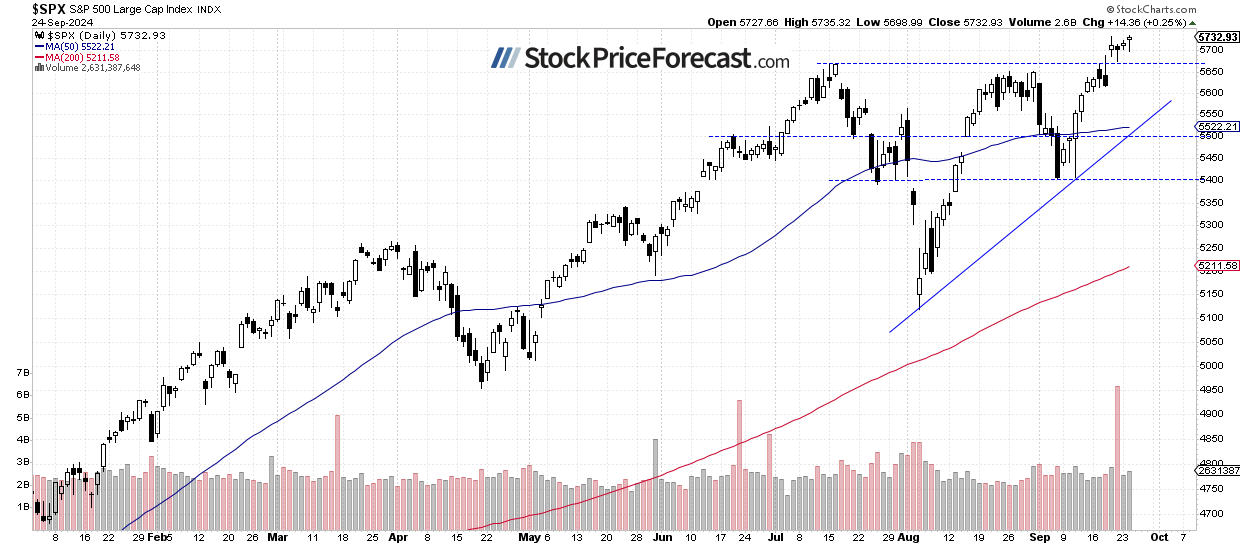

The S&P 500 index gained 0.25% on Tuesday, approaching last Wednesday’s record high of 5,733.57. Stock prices advanced after an intraday retreat, extending their short-term fluctuations following last week’s post-Fed rally. The question remains: Is this a topping pattern or merely a pause within an uptrend? This morning, the index is expected to open virtually flat, as indicated by futures contracts.

I still think that the market is forming a high, and the seasonal pattern will play out in such a way that indexes will set their highs in September, with the low of the correction occurring in October.

Therefore, I am maintaining a speculative short position, opened last Monday.

Investor sentiment improved last week, as shown by the Wednesday’s AAII Investor Sentiment Survey, which reported that 50.8% of individual investors are bullish, while only 26.4% of them are bearish, down from 31.0% last week.

The S&P 500 index continues to crawl near record highs, as we can see on the daily chart.

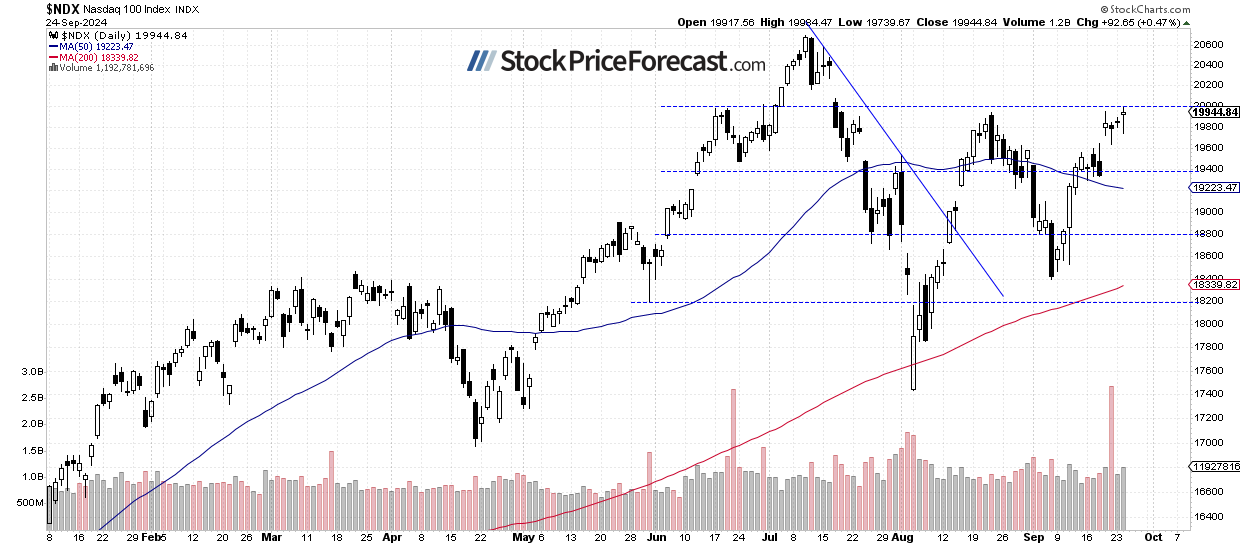

Nasdaq 100 Gets Near 20,000 Again

The tech-heavy Nasdaq 100 gained 0.47% on Tuesday, extending Monday’s gain of 0.3%. It remains weaker than the broader market, trading well below its July 10 record high of 20,690.97. The Nasdaq 100 is expected to open 0.2% lower this morning.

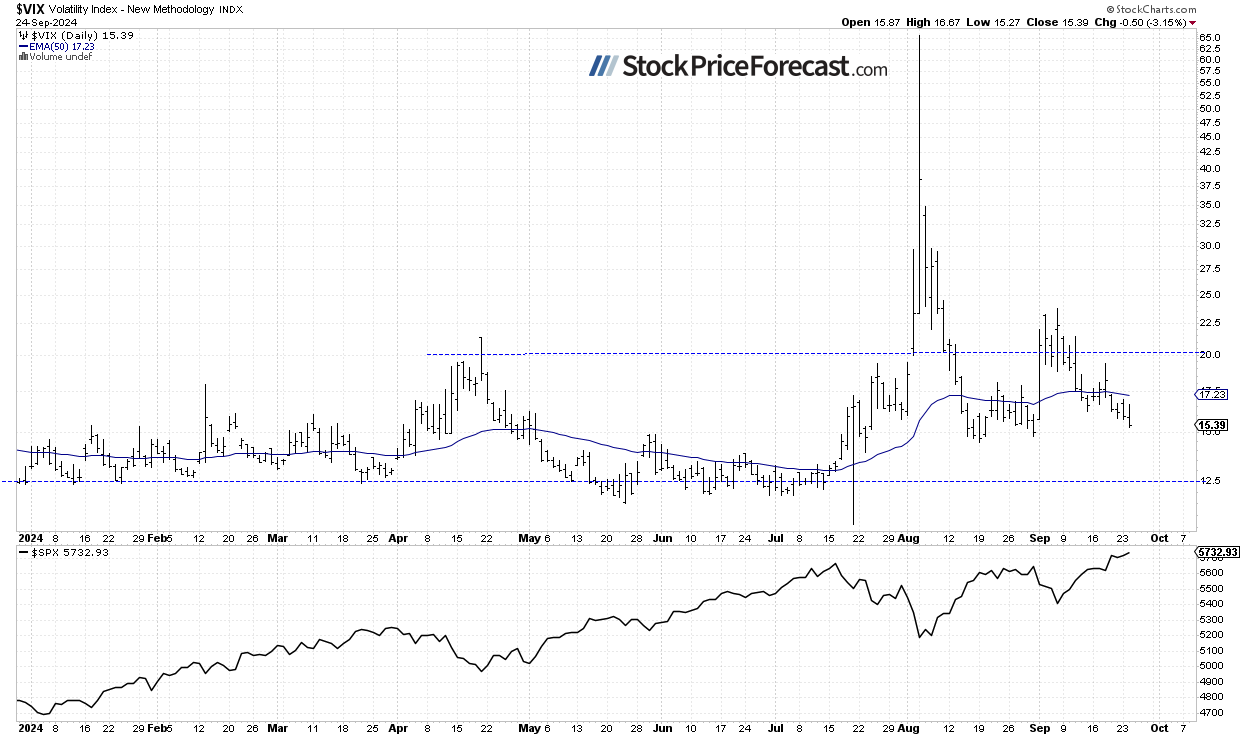

VIX Nears 15

On September 6, the VIX index, a measure of market fear, reached a local high of 23.76. It was indicating elevated fear among investors. However, a stock rebound last week pushed the VIX lower. Yesterday, it fell to 15.27, the lowest since late August.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures Contract: Fluctuating Below 5,800

Let’s take a look at the hourly chart of the S&P 500 futures contract. It’s still trading within a short-term consolidation, remaining below the resistance level of 5,800. On the other hand, the support lies in the 5,730–5,750 range.

Conclusion

While the S&P 500 reached a new record high on Thursday, the question remains: Is there more upside ahead for stocks? Today’s trading session is set to open flat, similar to yesterday’s.

Last Wednesday, I noted “A "buy the rumor, sell the news" scenario seems likely, but a bullish breakout to new highs can't be ruled out either.” Thursday’s rally invalidated a quick reversal scenario. While the overall market outlook remains bullish, this could also be the formation of a topping pattern before a more significant downward correction.

I opened a speculative short position in the S&P 500 futures contract last Monday.

In my Stock Price Forecast for September 2024, I noted that, “the market experienced significant volatility in August, with a roller-coaster ride that included a sell-off to the August 5 local low and a subsequent advance, leading to a consolidation near the record high. (…) sharp reversal suggests more volatility in September. Last month, I wrote that ‘August is beginning on a very bearish note, but the market may find a local bottom at some point.’ The same could be said today, and September will likely not be entirely bearish for stocks.”

For now, my short-term outlook remains bearish.

Here’s the breakdown:

- The S&P 500 continues to fluctuate after its post-Fed rally.

- The market may still be forming a topping pattern before a downward correction.

- In my opinion, the short-term outlook is bearish.

The full version of today’s analysis - today’s Stock Trading Alert - is bigger than what you read above, and it includes the additional analysis of the Apple (AAPL) stock and the current S&P 500 futures contract position. I encourage you to subscribe and read the details today. Stocks Trading Alerts are also a part of our Diamond Package that includes Gold Trading Alerts and Oil Trading Alerts.

And if you’re not yet on our free mailing list, I strongly encourage you to join it - you’ll stay up-to-date with our free analyses that will still put you ahead of 99% of investors that don’t have access to this information. Join our free stock newsletter today.

Thank you.

Paul Rejczak,

Stock Trading Strategist