Stocks Face Uncertainty Ahead of Data, Earnings, and Elections

Will Friday’s volatility lead to a downward correction, or was it just a temporary retreat?

Stocks were mixed on Friday, starting on a positive note, but sellers stepped in toward the session’s end, pushing prices lower. The S&P 500 closed 0.03% lower, continuing its short-term consolidation. This morning, futures indicate the index is likely to open 0.4% higher. Investors are anticipating a series of economic data releases and quarterly earnings from major companies this week. Additionally, the market is closely watching next week’s U.S. presidential elections.

Investor sentiment worsened considerably last week, as shown in Wednesday’s AAII Investor Sentiment Survey, which reported that 37.7% of individual investors are bullish, while 29.9% of them are bearish, up from 25.4% last week.

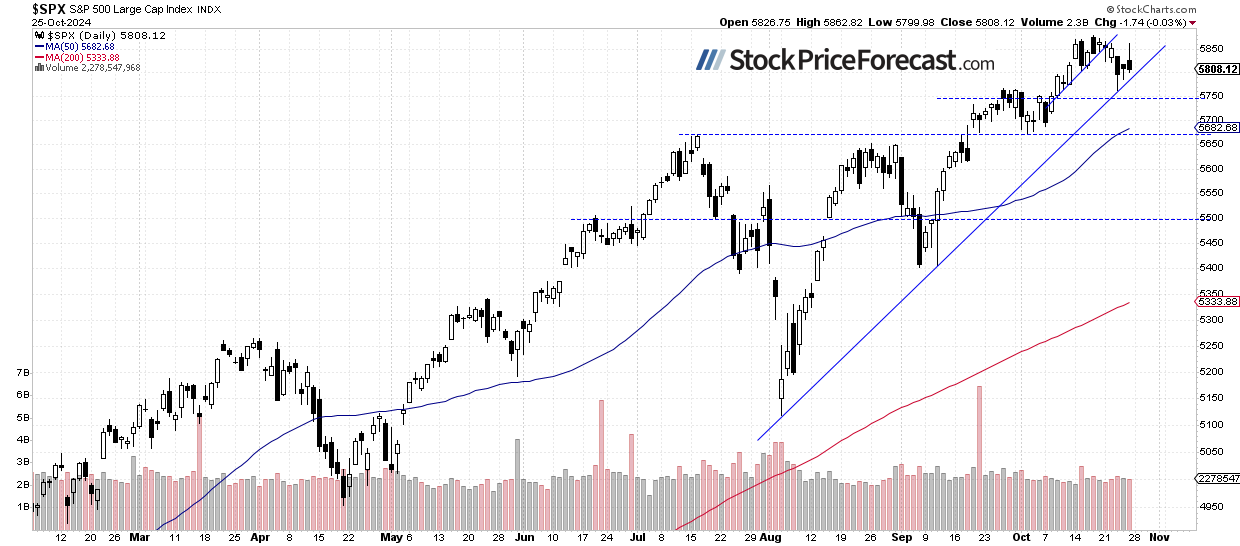

The S&P 500 remains near the 5,800 level, as we can see on the daily chart.

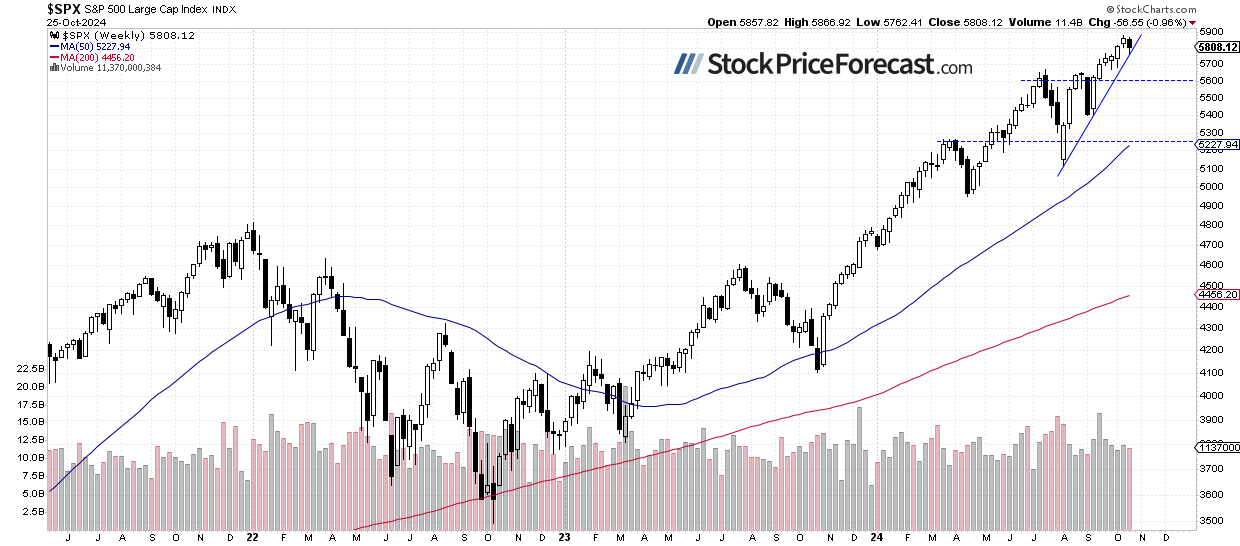

S&P 500: Weekly Correction

Compared to the prior Friday's close, the S&P 500 fell 0.96% last week, breaking its winning streak after a record-breaking run. The key support level is between 5,600-5,700, with potential resistance around 5,900-6,000.

Nasdaq 100: New Local High and Pullback

The Nasdaq 100 rose 0.59% on Friday, though it gave back most of its gains after reaching a new local high of around 20,553. On Thursday, it outperformed the broader market, driven by a 22% rally in TSLA stock after its earnings release. The Nasdaq 100 remained relatively strong on Friday and is set to open 0.5% higher today.

VIX: Above 20 Again

The VIX index, a measure of market volatility, closed above 20 on Friday, signalling some fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

Futures Contract: More Indecision

The S&P 500 futures contract rallied on Friday but ultimately pulled back from the 5,900 level. This morning, it is trading sideways after an overnight rebound due to some easing in Middle East tensions. Resistance remains at 5,900-5,925, with support at 5,800-5,825.

Conclusion

Stock prices will likely start the week on a positive note, with a 0.4% gain On Friday, I wrote “The S&P 500 is likely to fluctuate ahead of significant earnings reports over the next two weeks and the upcoming presidential elections.” This outlook still applies, as the market could experience more volatility due to economic data, earnings, and the upcoming presidential elections.

For now, my short-term outlook is neutral.

Here’s the breakdown:

- The S&P 500 failed to rally on Friday but is set to open higher this morning.

- This still appears to be an extended consolidation following the rally from September’s low.

- In my opinion, the short-term outlook is neutral.

The full version of today’s analysis - today’s Stock Trading Alert - is bigger than what you read above, and it includes the additional analysis of the Apple (AAPL) stock and the current S&P 500 futures contract position. I encourage you to subscribe and read the details today. Stocks Trading Alerts are also a part of our Diamond Package that includes Gold Trading Alerts and Oil Trading Alerts.

And if you’re not yet on our free mailing list, I strongly encourage you to join it - you’ll stay up-to-date with our free analyses that will still put you ahead of 99% of investors that don’t have access to this information. Join our free stock newsletter today.

Thank you.

Paul Rejczak,

Stock Trading Strategist