S&P 500 to Open Lower – Is This Just a Correction?

Stock prices will drop this morning – is this a new downtrend or still just a correction following last week’s rally?

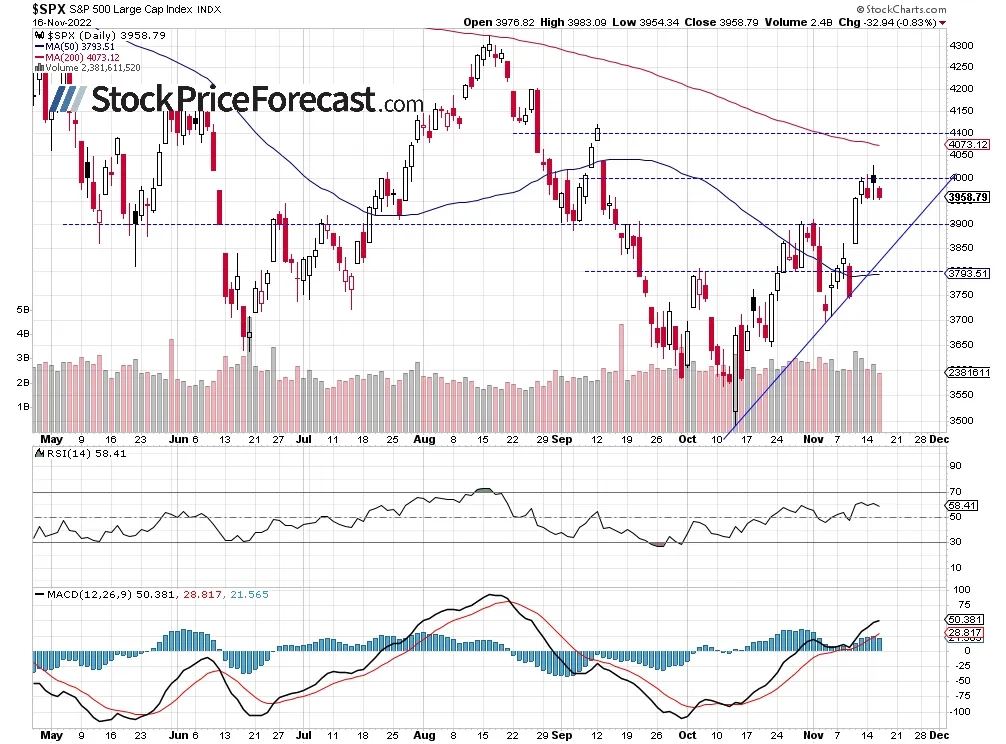

The S&P 500 index lost 0.83% on Wednesday, following its Tuesday’s gain of 0.9%, as it further extended a short-term consolidation below the 4,000 level. On Tuesday the broad stock market index reached new medium-term high of 4,028.84 and it was the highest since September 13. This morning it will likely break below the recent local lows along the 3,950 level. The sentiment deteriorates on uncertainty about the Fed’s monetary policy tightening, Russia-Ukraine conflict, among other factors.

The S&P 500 index continued to trade within a short-term consolidation yesterday, as we can see on the daily chart (chart by courtesy of http://stockcharts.com ):

Futures Contract Trades Lower

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it broke below a short-term consolidation along the support level of around 3,960. The next support level is at 3,900. (chart by courtesy of http://tradingview.com ):

Conclusion

The S&P 500 index extended a short-term consolidation on Wednesday. This morning it will likely retrace more of its last week’s rally. It’s expected to open 1.2% lower. For now, it still looks like a correction within a downtrend.

Here’s the breakdown:

- The S&P 500 bounced down from the 4,000 level yesterday, and today it is poised to open lower.

- It still looks like a correction within an uptrend.

Thank you.

Paul Rejczak,

Stock Trading Strategist