More Uncertainty Likely, as Stock Prices Continue Sideways

The broad stock market keeps going sideways ahead of the long holiday weekend.

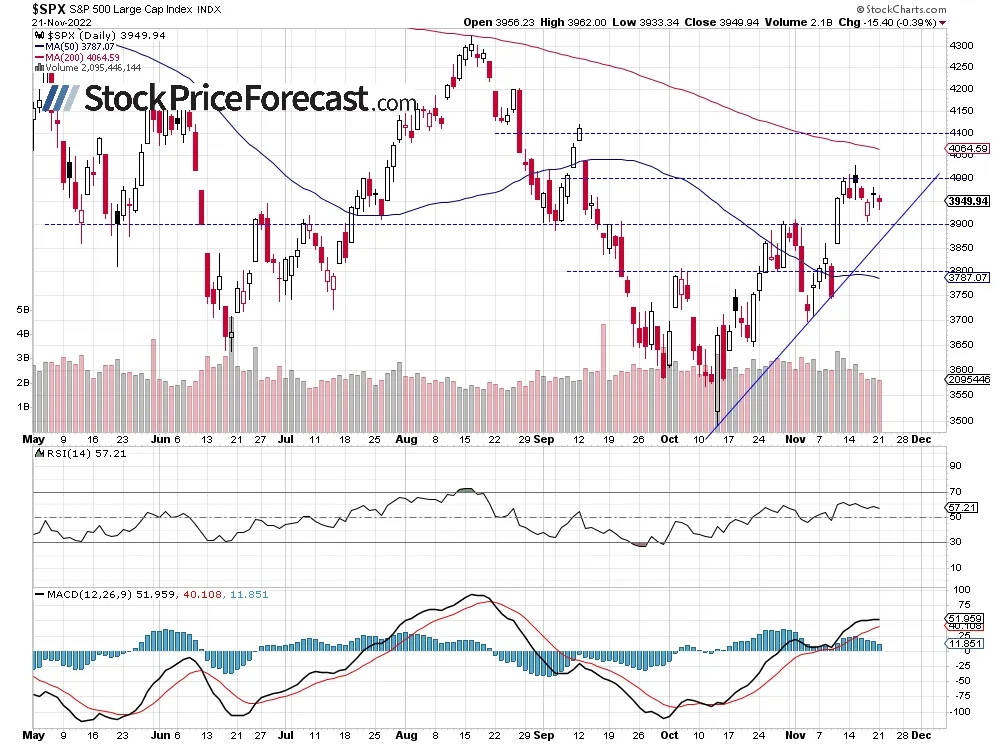

The S&P 500 index lost 0.39% on Monday, as it remained close to the 3,950 level. On Thursday it bounced local low of around 3,907, and on Friday it was as high as 3,980. Yesterday it retraced some of the advance on a relatively quiet trading day. Stock prices continue to fluctuate following their recent rally from the 3,750 level.

This morning the S&P 500 is expected to open 0.5% higher, so we will see more short-term sideways trading action below the 4,000 level. Investors will wait for tomorrow’s important economic data releases, including the PMI numbers and the FOMC Meeting Minutes releases, but overall, we may see a lower activity ahead of the long holiday weekend in the U.S.

The S&P 500 index extends its consolidation, but it continues to trade above an over month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com ):

Futures Contract Remains Below the 4,000 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. It continues to trade below the resistance level of 4,000-4,050. On the other hand, the support level is at 3,900-3,920. (chart by courtesy of http://tradingview.com ):

Conclusion

Stock prices will likely open higher this morning, and the S&P 500 will further extend its short-term consolidation. The broad stock market’s gauge remains relatively close to the 4,000 level. For now, it still looks like a flat correction or within an uptrend.

Here’s the breakdown:

- The S&P 500 will extend its short-term fluctuations this morning.

- It still looks like a consolidation or a relatively flat correction within an uptrend.

Thank you.

Paul Rejczak,

Stock Trading Strategist